When it comes to financial management, the strategies and priorities differ significantly between startups and established organizations. Understanding these differences is crucial for the success and sustainability of any business. In this article, we will explore the unique aspects of financial management in both startup and established settings.

Financial Management in Startups

1. Resource Allocation: Startups often operate with limited resources. Effective financial management in this context means carefully allocating funds to critical areas like product development, marketing, and talent acquisition. The focus is on achieving rapid growth and scalability.

2. Cash Flow: Cash is king for startups. Managing cash flow is a top priority, as running out of funds can spell disaster. Startups must forecast cash needs, monitor expenses closely, and explore avenues for short-term financing.

3. Risk-Taking: Startups are inherently risk-tolerant. Financial management here involves taking calculated risks to seize opportunities for innovation and market disruption. Investors expect a higher risk-reward profile.

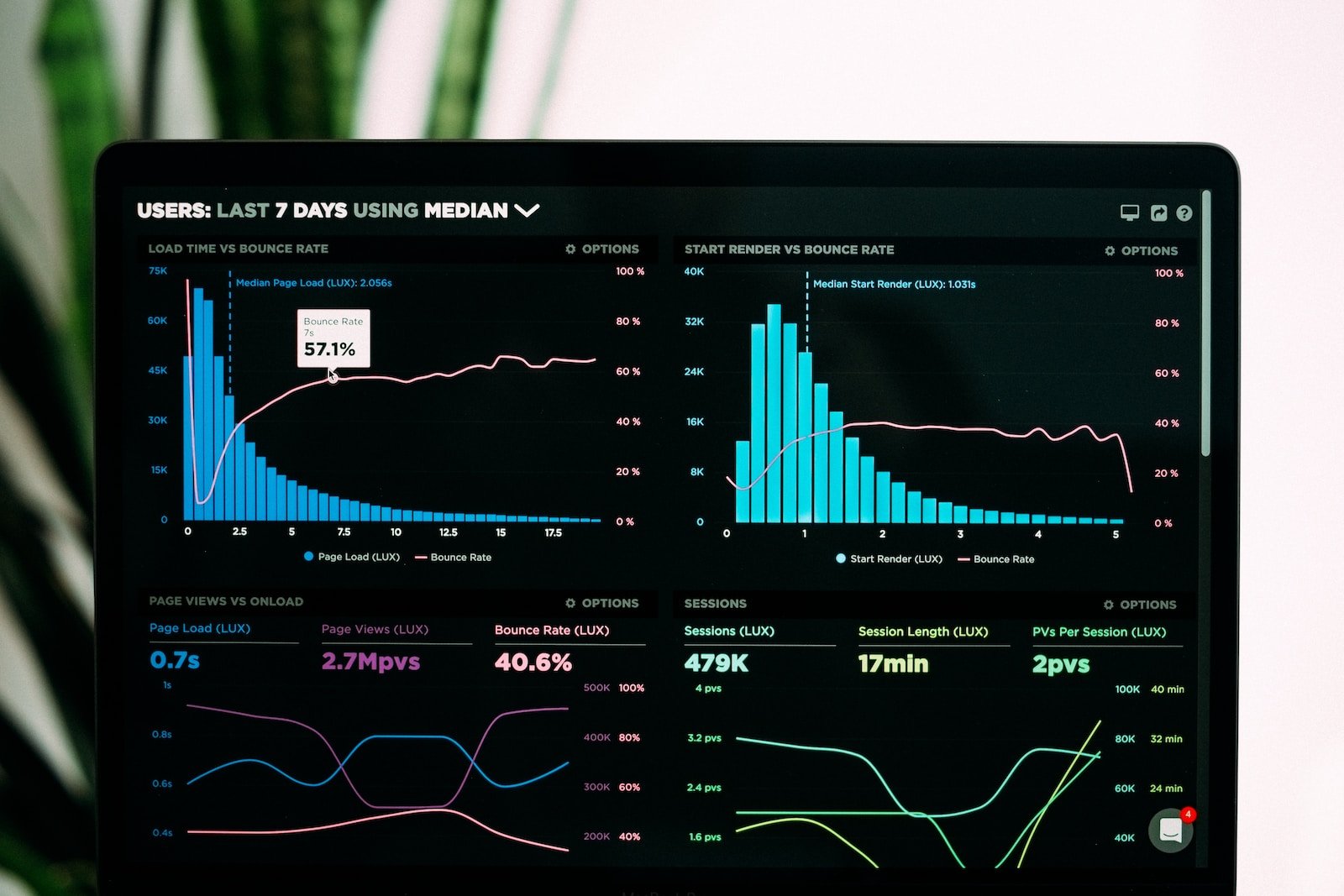

4. Financial Modeling: Startups rely heavily on financial models to make informed decisions. These models project revenue, expenses, and growth trajectories, helping founders and investors understand the path to profitability.

Financial Management in Established Organizations

1. Stability and Growth: Established organizations prioritize stability and sustainable growth. Financial management focuses on optimizing existing operations, improving profitability, and strategic long-term planning.

2. Risk Mitigation: Established companies tend to be more risk-averse. Financial management involves minimizing risks associated with market fluctuations, regulatory changes, and economic downturns.

3. Investor Relations: For publicly traded companies, managing relationships with shareholders and institutional investors is crucial. Transparency and consistent financial performance are key.

4. Diversification: Established organizations often diversify their investments and revenue streams to reduce dependence on a single product or market. Financial management includes portfolio diversification and mergers/acquisitions.

Common Principles for Both

While there are clear distinctions, some financial management principles apply to both startups and established organizations:

- Budgeting: Both need effective budgeting to control expenses and allocate resources optimally.

- Financial Reporting: Accurate financial reporting and compliance with accounting standards are essential for transparency and trust.

- Tax Planning: Efficient tax planning can significantly impact the bottom line for both startups and established companies.

- Capital Management: Managing capital and seeking appropriate financing options is critical for growth and sustainability.

In conclusion, financial management is a dynamic process that evolves as a business grows. Startups prioritize rapid growth, cash flow, and risk-taking, while established organizations focus on stability, risk mitigation, and investor relations. Understanding these differences and applying common financial management principles is vital for achieving success in both contexts.